We explore the broker’s offerings including its available bonuses, MetaTrader 4 platform, forex trading features, deposit and withdrawal methods, and various account types. This analysis helps you compare Tickmill with other top forex brokers and determine if it aligns with your trading needs.

Tickmill is a well-established and trusted name in the forex and CFD markets. Founded in 2007, the broker has earned a reputation for offering competitive spreads across a broad range of global assets. While Tickmill operates internationally, one of its offices is located in Sydney, Australia, at 6/309 Kent Street, NSW 2000.

Tickmill is known for delivering cost-effective trading solutions that cater to all levels of traders—from beginners to professionals. Their bonus programs, paired with tight spreads and efficient execution, make it a preferred choice for many.

MT4

Our Tickmill review highlights that the broker offers access to the globally renowned MetaTrader 4 (MT4) platform, available on Windows, Mac, and WebTrader. Known for its stability and functionality, MT4 is a top choice for traders around the world. Here’s what you can expect when trading with Tickmill through this platform:

- Trade CFDs on forex, indices, commodities, and bonds

- No partial fills, deeper liquidity, and efficient order execution

- Expert Advisor (EA) compatibility with VPS hosting

- Over 50+ technical indicators, advanced charting tools, and support for 39 languages

There is not a lot that is left to be desired when they have the MT4 platform available for you to use. The MT4 mobile app provides as a Tickmill bonus feature will give you access to the following things:

-

Real-time market quotes

-

Full access to asset classes

-

Technical indicators for mobile analysis

-

Trade execution directly from charts

You will also have access to Autochartist, a Plugin for Mt4 on Windows only that detects key chart patterns and price analysis patterns and other offers.

Demo

Tickmill offers resources specifically designed for new traders. Understanding the tools and technology used in trading is essential, especially for beginners who are just entering the market.

To support this learning process, Tickmill provides a free demo account, allowing users to explore the platform, test strategies, and become familiar with the trading environment—without risking real capital. It’s an excellent opportunity to practice, gain confidence, and understand all the platform features before transitioning to a live trading account.

Broker

Our Tickmill review confirms that the broker is well-regulated, with a clean reputation and no history of scandals or compliance issues. Client funds are held in segregated accounts, ensuring they remain separate from the broker’s operational capital—an essential measure of financial integrity.

For added protection, Tickmill partners with tier-1 banks, recognized globally for their financial strength and stability. This enhances the overall safety of client deposits and reflects Tickmill’s commitment to responsible fund management.

When it comes to trading, Tickmill offers access to 60+ currency pairs, giving traders a broad and flexible forex portfolio. Although EU regulations prohibit most promotional bonus offers, Tickmill still provides value-added incentives where allowed, such as the $30 Welcome Bonus and the “Trader of the Month” reward program—both of which serve as performance-based perks for active traders.

Account Types

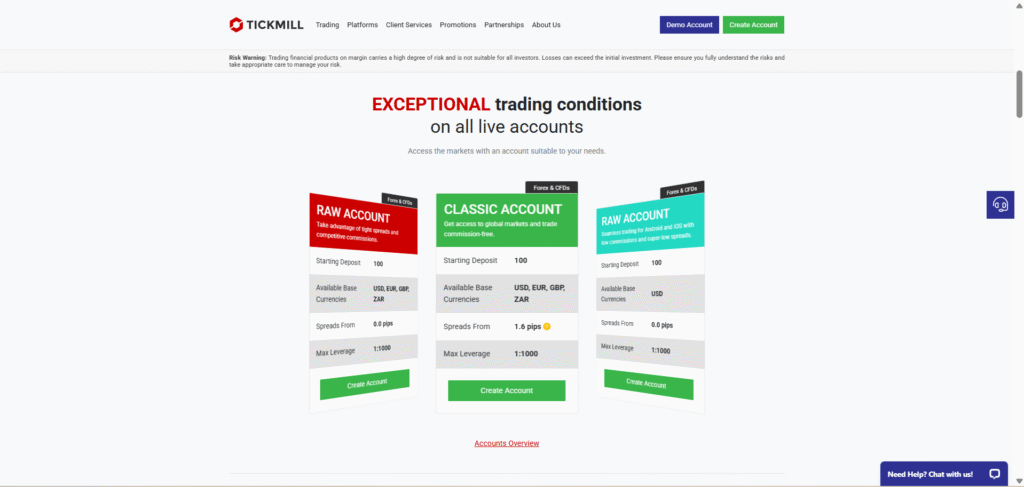

Our Tickmill review highlights that the broker offers three core account types tailored to suit various trading styles and experience levels:

-

Classic Account – Ideal for beginners, this account has no commissions and features slightly wider spreads. It’s perfect for those just starting out in forex trading.

-

Pro Account – Designed for more experienced traders, this account offers tight spreads with a commission of $2 per side per standard lot. It provides access to institutional-level pricing with a low minimum deposit.

-

VIP Account – Best suited for high-volume traders, the VIP account offers ultra-low spreads and lower commission fees. A significantly higher minimum balance is required to qualify for this account type.

Each account varies in minimum deposit, maximum leverage, and spread/commission structure, allowing traders to choose the option that best aligns with their trading goals.

Tickmill Customer Support & Account Opening

One area where Tickmill truly stands out is its exceptional customer service. As a global online broker, Tickmill offers multilingual support 24 hours a day, five days a week, ensuring traders from around the world receive timely and effective assistance.

The platform is built on a secure, encrypted system that safeguards user data and trading activity. With years of experience in the online trading industry, Tickmill has established a reputation for reliability, offering competitive services and access to advanced trading platforms for both novice and professional traders.

Opening an account with Tickmill is straightforward—simply complete the online application form, submit your personal details, and make a minimum deposit of USD 200 to get started.