BDSwiss, founded in 2012, is a highly regarded online broker with over 1 million active traders. The broker operates under the FSA, FSC, FSCA, and MISA regulations, ensuring a safe and secure trading environment. Offering competitive spreads starting from 0.0 pips, a wide range of account types, and educational resources like courses and webinars, BDSwiss caters to both beginner and advanced traders.

With an impressive leverage of up to 1:500 and support for over 250 CFDs, BDSwiss is a strong choice for those seeking a reliable trading platform.

| 🔎 Broker | 🥇 BDSwiss |

| 📌 Year Founded | 2012 |

| 👤 Amount of Staff | Over 200 |

| 👥 Amount of Active Traders | Over 1,000,000 |

| 📍 Publicly Traded | None |

| 📈 Regulation | FSA, FSC, FSCA, MISA, SCA |

| 📉 Country of Regulation | Cyprus, Seychelles, Germany |

| 📊 Account Segregation | ✅Yes |

| 💹 Negative Balance Protection | ✅Yes |

| 💱 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | ✅Yes |

| 💴 Minor Account Currencies | 10+ |

| 💶 Minimum Deposit | $100 |

| ⏰ Average Deposit/Withdrawal Processing Time | 1-3 business days |

| 💵 Fund Withdrawal Fee | Varies by method |

| ➡️ Spreads From | 0.0 pips (for Raw account) |

| 💷 Commissions | Varies by account type |

| 💰 Number of Base Currencies Supported | 20+ |

| 🔃 Swap Fees | ✅Yes |

| 📑 Leverage | Up to 1:500 |

| ▶️ Margin Requirements | Varies by instrument and leverage |

| ☪️ Islamic Account (Swap-Free) | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| ⏱️ Order Execution Time | 0.1 – 0.3 seconds |

| 🔖 VPS Hosting | Yes (for clients meeting criteria) |

| 1️⃣ CFDs – Total Offered | 250+ |

| 2️⃣ CFD Stock Indices | 15+ |

| 3️⃣ CFD Commodities | 10+ |

| 4️⃣ CFD Shares | 100+ |

| 💴 Deposit Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💶 Withdrawal Options | Bank Transfer, Credit/Debit Cards, E-wallets |

| 💻 Trading Platforms | MT4, MT5, BDSwiss Mobile App, BDSwiss WebTrader |

| 🖥️ OS Compatibility | Windows, macOS, iOS, Android |

| ⚙️ Forex Trading Tools | Economic Calendar, Trading Signals |

| 🥰 Live Chat Availability | ✅Yes |

| 💌 Customer Support Email Address | [email protected] |

| ☎️ Customer Support Contact Number | +44 203 695 4343 |

| ⭐ Social Media Platforms | Facebook, Twitter, |

| 🏷️ Languages Supported on Website | 20+ |

| 📔 Forex Course | ✅Yes |

| 📚 Webinars | ✅Yes |

| 📒 Educational Resources | Articles, webinars, tutorials |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 IB Program | ✅Yes |

| 🏆 Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ❤️ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Safety and Security:-

BDSwiss, a leading financial institution since 2012, has grown to serve over 1.7 million clients globally with a monthly trading volume exceeding $84 billion. The broker is regulated in multiple jurisdictions, including Seychelles (FSA), Mauritius (FSC), the UAE (SCA), and other regions. Furthermore, BDSwiss ensures a safe and transparent trading environment with client fund protection, segregation of accounts, and high-level regulatory oversight.

Partnership Options:-

BDSwiss offers a highly competitive Partnership Program that has attracted over 20,000 affiliates and introducing brokers (IBs) worldwide. With a global reach in over 180 countries, the program features flexible commission structures, free marketing materials, personalized support, and high conversion rates.

In addition, Partners can benefit from competitive remuneration, cutting-edge tools, and opportunities for significant payouts, with up to $2.7 million in partner payouts monthly.

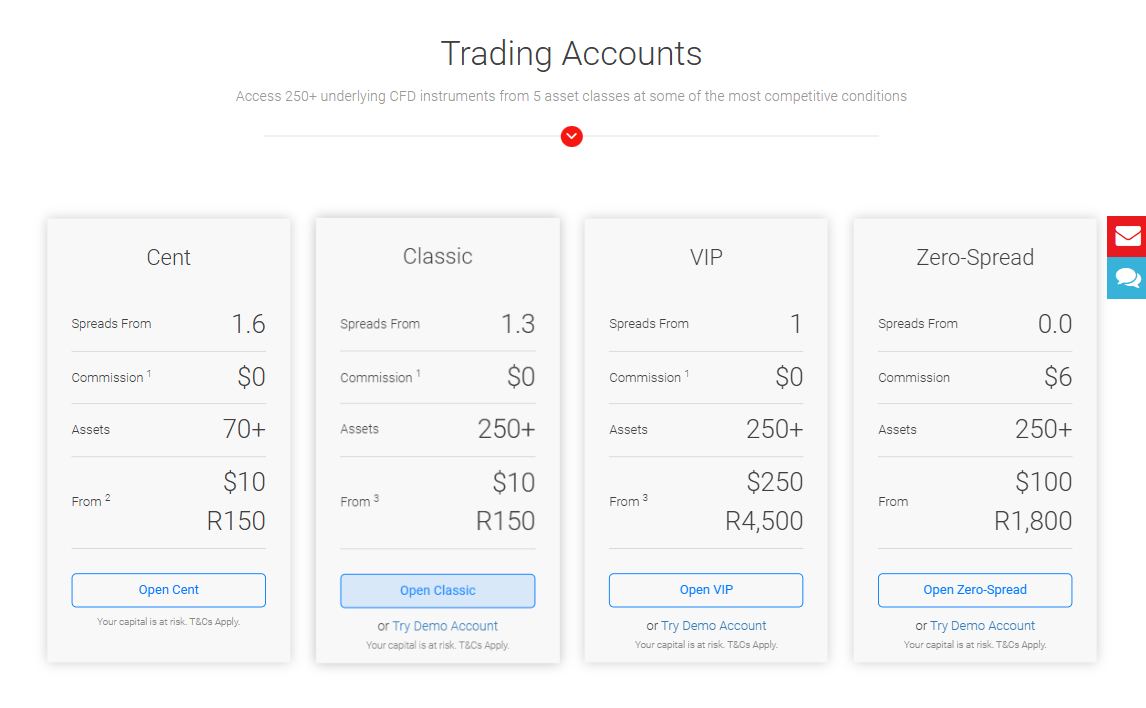

Minimum Deposit and Account Types:-

BDSwiss offers a variety of account types to suit different trading preferences and experience levels. The Cent, Classic, VIP, and Zero-Spread accounts all provide access to 250+ CFDs across various asset classes. Account minimum deposit requirements range from $10 for the Cent account to $250 for the VIP account.

Furthermmore, traders can enjoy flexible leverage options, from 1:400 to 1:2000, depending on the account type, along with dynamic leverage that adjusts based on position size.

Trading Platforms and Tools:-

BDSwiss offers a variety of advanced trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary WebTrader and Mobile App. These platforms are designed to cater to both beginners and experienced traders, providing sophisticated tools, real-time market quotes, and automated trading options. MT5, for example, supports over 80 technical indicators, while BDSwiss WebTrader features exclusive trend analysis tools.

In addition, the mobile app allows trading on the go, with real-time quotes, interactive charts, and 24/7 access to cryptocurrency pairs.

Markets Available for Trade:-

BDSwiss offers access to over 250 CFD instruments across five major asset classes: Forex, Stocks, Indices, Commodities, and Cryptocurrencies. Traders can access these markets via a range of platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), BDSwiss WebTrader, and the Mobile App.

Moreover, with highly competitive spreads and dynamic leverage options, BDSwiss provides a diverse and flexible trading environment for investors interested in both traditional and emerging financial markets.

Fees, Spreads, and Commissions:-

BDSwiss offers competitive spreads starting from 1.6 pips for the Cent account and as low as 0.0 pips for the Zero-Spread account. There are no commissions on forex, crypto, and commodity pairs across all account types. However, for other CFDs, such as indices and shares, commissions vary based on the account type, with commissions starting at $2 for indices and 0.15% for shares. In addition, BDSwiss also provides zero fees on deposits and credit card withdrawals.

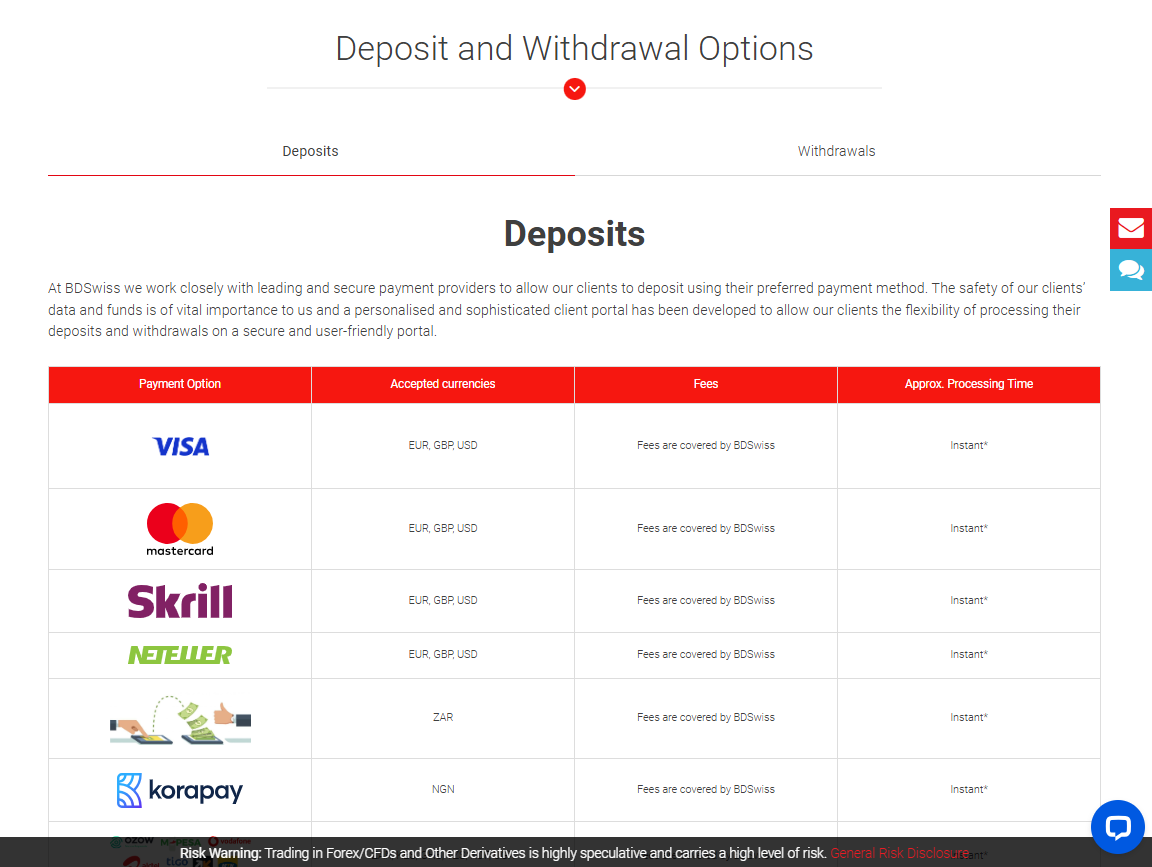

Deposit and Withdrawal:-

BDSwiss offers a wide range of secure deposit and withdrawal options for clients, including popular payment methods such as Visa, Mastercard, Skrill, Neteller, and various local payment systems like MPESA and PayPal. Deposits are processed instantly for most methods, while withdrawals are typically processed within 24 hours.

In addition, BDSwiss covers all receiving costs, and clients are advised to use the same method for withdrawals as for deposits. To ensure security and compliance, withdrawals are subject to full account verification.