Admiral Markets was established in 2001, making it one of the longest-standing forex brokers in the industry. With nearly two decades of experience, it’s easy to assess their performance and credibility. In our view, brokers that sustain such longevity typically do so by consistently delivering on their promises.

Headquartered in the U.K., Admiral Markets has earned a reputation as one of the top global trading platforms.

| 🏢 Headquarters | UK |

| 📆 Established | 2001 |

| 🗺️ Regulation | ASIC, FCA, CySEC, EFSA |

| 🖥 Platforms | MT4 & MT5 |

| 📉 Instruments | Metals ,currencies, CFDs trading |

| 💳 Minimum Deposit | $100 |

| 💰 Deposit Methods | Bank Wire, VISA, MasterCard, iBank & BankLink, iDEAL, Klarna, Neteller |

| 📱 Mobile Trading | Available |

| 🌍 Web Trading | Available |

| 💵Minimum Trade Size | 0.01 |

| 🎢 Maximum Leverage | 1:30 |

| 🌍 ECN | Available |

| 🤖 Robots | Available |

| 🎯 Scalping | Allowed |

| ☎ Customer Support | 24/5 |

Regulation

Admiral Markets is considered one of the most secure brokers in the industry. According to their official regulation page, they are licensed and supervised by several top-tier financial authorities, including:

-

The U.K.’s Financial Conduct Authority (FCA)

-

Australian Securities and Investments Commission (ASIC)

-

Cyprus Securities and Exchange Commission (CySEC)

-

Estonian Financial Supervision Authority (EFSA)

We independently verified each regulatory body listed and found all information to be accurate and consistent.

During our in-depth Admiral Markets review, we also identified several investor protection measures offered by the broker:

-

They publish annual, publicly accessible reports detailing their operations and financial performance.

-

They offer negative balance protection, ensuring clients can’t lose more than their account balance.

-

They are part of the Financial Services Compensation Scheme (FSCS).

-

Client funds are kept in segregated accounts with EEA-regulated credit institutions, separate from the company’s operational funds.

Bonus for Deposits and Promotions

Admiral Markets does not provide any bonuses or promotional offers, in compliance with regulatory guidelines. Additionally, their cash rebate program is exclusively available to professional clients.

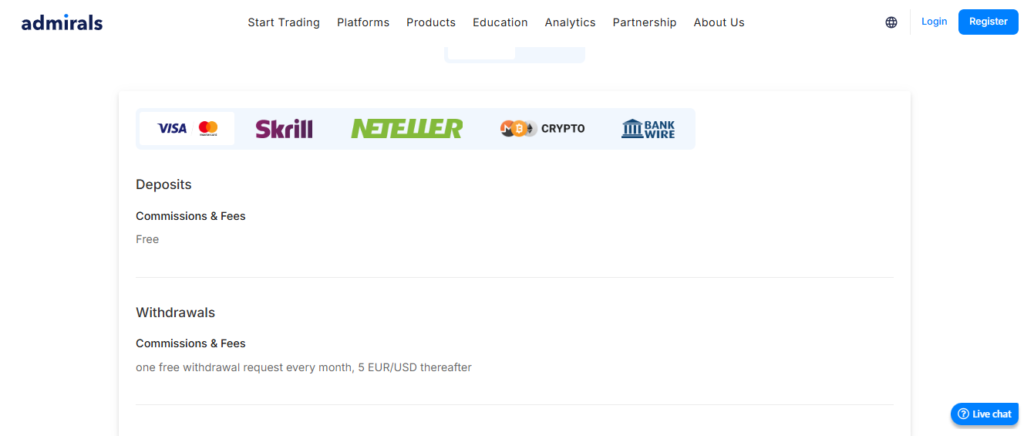

Deposit Options

When it comes to payments, customers naturally prefer reliable and convenient methods. While most brokers aim to provide a wide range of options, Admiral Markets offers a somewhat limited selection for deposits and withdrawals, which may pose challenges for some users. For example, transactions via Skrill incur a 0.9% fee.

That said, most other payment methods are free of charge, aside from potential third-party fees. Clients are advised to choose the method that best suits their needs. Admiral Markets currently supports the following payment options:

-

Bank transfers

-

Visa

-

Mastercard

-

Neteller

-

Skrill

-

SafetyPay

-

Przelewy

-

iBank

-

iDEAL

While not the most extensive list in the industry, these options are generally sufficient for most traders to fund or withdraw from their accounts with ease.

Withdrawal Options

Investors can initiate withdrawals directly from the Trader’s Room using several available methods. These include: credit cards, Skrill, Neteller, Cryptos, and Wire Transfer.

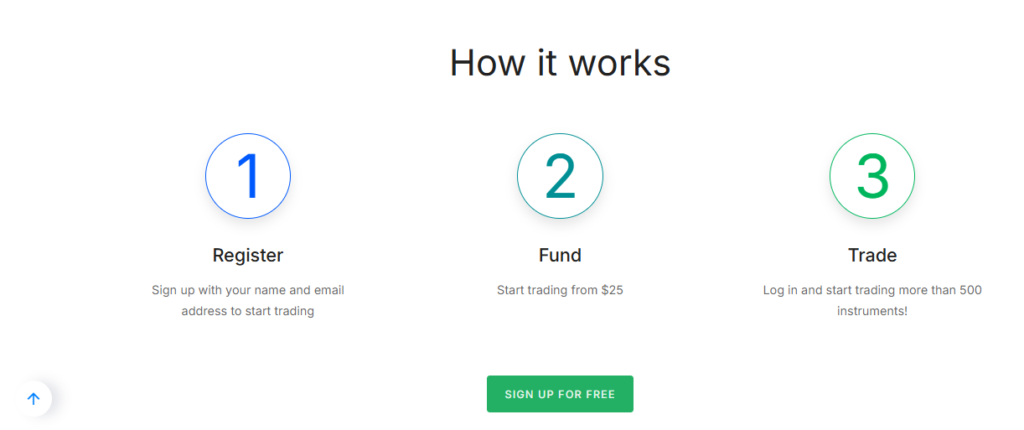

Account Opening

To access Admiral Markets’ services, traders must first create an account. The process begins by submitting a valid form of identification (such as a passport or government-issued ID) and a document verifying your place of residence. Once these documents are submitted, Admiral Markets will verify them in accordance with their AML (Anti-Money Laundering) and KYC (Know Your Customer) policies. If all criteria are met, the account will be successfully opened.

Once registered and a deposit is made, traders gain full access to forex trading through the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms.

After completing registration, users can log in to the Admiral Markets Trader’s Room, where they can manage their trading activities. From here, they can open either a live trading account or a demo account and download the appropriate trading platforms.

To open a live account, simply click on “Open Live Account” and follow the on-screen instructions. You’ll need to provide answers to a few basic questions during the verification process. Be sure to have your identity and address documents ready—such as a national ID, passport, or a recent utility bill—to complete the verification smoothly.

Account Types

Investors ready to start trading with Admiral Markets can choose from a variety of account types, depending on the trading platform they prefer—MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Each account type is designed to suit different trading strategies and experience levels.

For beginners, Admiral Markets offers a demo account, allowing new traders to practice and familiarize themselves with the platform using virtual funds. Additionally, an Islamic account is available for Muslim traders, which complies with Shariah law by excluding swap or interest charges.

In the sections that follow, we’ll review each major account type in detail to help you determine which one best fits your trading goals and preferences.

MT4 Accounts

Admiral Markets Trade.MT4

This account provides traders with a wide range of features and access to multiple trading instruments, including forex, indices, stocks, and bonds. With a minimum deposit requirement of just 100 USD, EUR, GBP, or CHF, it offers a flexible entry point for most traders.

Retail clients benefit from leverage ranging between 20:1 and 30:1, while professional traders can access leverage as high as 500:1.

Key specifications include:

-

Minimum forex order size: 0.01 lots

-

Minimum spread: From 0.5 pips

-

Maximum open and pending orders: 200

This account is well-suited for traders seeking a balanced mix of features, competitive conditions, and access to global markets.

Admiral Prime Zero. MT4

This account is ideal for traders looking to access a broader range of markets beyond the standard offering. It’s particularly suitable for those interested in CFD trading on spot energy, spot metals, and cash indices.

Key features of this account include:

-

Access to more instruments compared to the standard account

-

Minimum spreads starting from 0.0 pips

-

Commissions ranging between $0.00 and $1.80 per lot

-

Leverage: Same as the standard account (20:1 to 30:1 for retail clients; up to 500:1 for professional clients)

This account is best suited for active

MT5 accounts

Admiral Markets Trade. MT5

The minimum deposit for this account is also $100, and once activated, traders gain access to all asset classes and thousands of tradable instruments. The base currencies for this account are the same as those available for MT4 accounts.

A standout feature of this account is its ability to support up to 500 open and pending orders simultaneously. Additional features offered by the Admiral Markets Trade.MT5 account include:

-

Expert Advisors (EAs) for automated trading

-

One-click trading for quick execution

-

Level II pricing for more detailed market depth

-

Special settings tailored to individual trading strategies

-

MetaTrader Supreme Edition add-on for enhanced functionality

As with other account types, traders also have the option to open an Islamic account, ensuring compliance with Shariah law for Muslim clients. This account is ideal for those seeking advanced trading tools and more flexibility in order management.

Admiral Invest. MT5

The Pro.MT5 account is primarily designed for professional investors, but it’s not limited to just experienced traders. Retail clients can also use this account to take advantage of its features, which include access to over 4,350 stocks and up to 500 ETFs.

This account stands out from others because it supports exchange execution for trades, providing a more direct connection to the markets.

While it shares many features with the Trade.MT5 account, there are some key differences:

-

No stop-out for retail clients

-

No negative balance protection

-

No Islamic account option

-

No hedging allowed

-

No maximum or minimum order size

This account is ideal for traders who require advanced market access and are comfortable with more flexibility, but it is important to note that it may not be suitable for beginners due to its lack of certain protections and features.

Admiral Markets Zero. MT5

The Admiral Markets Zero.MT5 account shares many similarities with the first two account types but is focused specifically on trading currencies, metals, cash indices, and energy CFDs. The leverage for forex and indices is the same as the Trade.MT5 account.

Key features of this account include:

-

Maximum order size: 200

-

Maximum open and pending orders: 500

-

No Islamic account option

This account offers traders a straightforward choice for those who focus on CFDs, with a simple yet efficient structure. Traders can choose this or any of the other accounts based on their analysis and preferred trading conditions.

Now that you’re familiar with the various account types and their features, let’s move on to the trading platforms offered by Admiral Markets.

Technical Analysis with Trading Central

Technical Insight is a proprietary tool that provides actionable analysis for every financial instrument, helping traders make informed decisions. The analysis is both optimized and proactive, offering educational guidance and customizable options tailored to achieve the desired outcomes.

One of the standout features is the Forex Featured Ideas indicator, which provides a wealth of unbiased trade ideas. Powered by the award-winning Trading Central’s pattern recognition algorithm, this tool helps traders identify potential opportunities with a high level of accuracy.

The Mini-Terminal

The mini-terminal makes it easier than ever to open and manage your trading positions. It enhances efficiency with preset options for stop-loss, trailing stop, and take-profit levels.

Additionally, the mini-terminal includes a built-in lot-size and margin calculator and provides order templates for OCO (One Cancels Other) and OCA (One Cancels All) order types.

Traders will also benefit from smart order lines for partial position closures, customizable time-based stops, quick order reversal, and hedging, offering more flexibility and control over trades.

The Trade Terminal

The trading terminal offers all the features of the mini-terminal, along with additional advanced capabilities. It allows for multi-currency trade management, making it easier to handle multiple positions across different currencies.

Key features include:

-

Easy order template creation for quicker trade setups

-

Multiple order partial closures for more precise position management

-

Account notifications, keeping you updated across all your accounts

With these enhanced tools, you can stay fully in control of your trades and manage them more effectively.

Tick Chart Trader

This tool allows you to effortlessly track price movements and identify the best entry points or monitor price action in real time. With features such as different chart types, direct trading from the tick chart, and the ability to track price movements, you can make more informed decisions and execute trades with precision.

Real-time News in MetaTrader

The platform provides direct access to essential news, eliminating the need for third-party sources. It features an economic calendar, RSS feeds, and in-depth analysis, ensuring you stay informed. Additionally, you can access accurate and comprehensive trading stats for your account, helping you make more informed decisions for future trades.

Indicator Package

This package is ever-expanding to include almost every advanced indicator you will ever need. You can get more information out of your charts and the best signals to inform your strategies.

The Trading Simulator

This tool will allow you to come up with strategies and test them to make sure that they work the way you intend them to work. That way, you will be able to get the most out of your analysis. If you can tweak your strategies to make the bulletproof, you will be able to make more money and position yourself in the right places most of the time.

Commissions and Spreads

Admiral Markets generates revenue through a combination of spreads and commissions. There are two main account types based on pricing structures:

-

Commission-free accounts: These accounts have higher spreads for forex trading.

-

Accounts with lower spreads: These accounts charge a commission on trades.

Both ETFs and CFDs carry a commission on all account types.

Given the wide range of instruments offered by Admiral Markets, the pricing structure for each account type can vary. For a complete breakdown of trading fees, it’s important to review the specific account details.

Additionally, jurisdictional differences can affect the rules and fee structures, so it’s essential to verify your trading fees based on your country’s regulations to understand the exact terms.

Commissions are typically calculated based on the monthly trading volume.

To better understand the fee structure and identify the account type that best fits your needs, it’s highly recommended to use a demo trading account. This allows you to explore the different account options and experience the associated fees firsthand.

Education and Research

Admiral Markets is highly regarded for its educational offerings, especially for new investors. Beginners in the trading industry can access a nine-lesson Forex 101 course designed to provide a comprehensive understanding of how the markets work.

To get started, all you need to do is open a demo account. This allows you to complete the lessons and gain the experience necessary to trade confidently. The course is further supported by free webinars, YouTube videos, and tutorials, which are offered periodically to help reinforce the learning process.

For research, traders have access to a wide range of forex tools and resources available directly on the Admiral Markets website, providing all the support needed to make informed trading decisions.

Customer Service Experience

Customer support is crucial to Admiral Markets’ success, and the firm ensures traders are well taken care of. The support team is easily reachable through phone, email, webform, and live chat, allowing for quick and convenient assistance.

Traders can contact the reliable support team 24/7 to resolve any issues or get answers to their questions. Additionally, multilingual support is available on weekdays to cater to a diverse range of clients. For quick solutions, the FAQ section on the website also addresses many common questions and provides immediate help.