Tickmill, the trading name of Tickmill Group of companies, is a regulated global forex and CFD brokerage company established in 2014, headquartered in London, UK. Tickmill offers trading in 60+ currency pairs, 15+ indices, 500 stocks & ETFs, bonds, commodities (precious metals and energies), cryptos, futures & options with three choices of trading accounts, which are the Classic, Raw, and Tickmill Trader Raw accounts. The available trading platforms include MetaTrader4/5 and Tickmill Trader

What Type of Broker is Tickmill?

Tickmill operates as a no dealing desk (NDD) broker. This means that the broker doesn’t take the other side of clients’ trades but instead passes them on to liquidity providers. Tickmill offers both retail and institutional trading services and provides access to a wide range of financial instruments. They also offer various trading platforms and account types to suit different trading styles and needs.

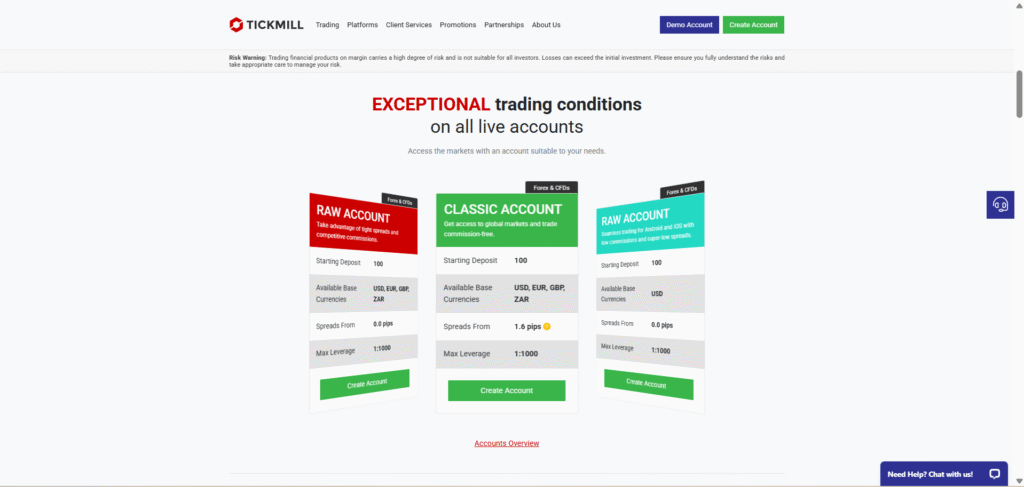

Account Types

Our Tickmill review highlights that the broker offers three core account types tailored to suit various trading styles and experience levels:

Classic Account – Ideal for beginners, this account has no commissions and features slightly wider spreads. It’s perfect for those just starting out in forex trading.

Pro Account – Designed for more experienced traders, this account offers tight spreads with a commission of $2 per side per standard lot. It provides access to institutional-level pricing with a low minimum deposit.

VIP Account – Best suited for high-volume traders, the VIP account offers ultra-low spreads and lower commission fees. A significantly higher minimum balance is required to qualify for this account type.

Each account varies in minimum deposit, maximum leverage, and spread/commission structure, allowing traders to choose the option that best aligns with their trading goals.

Trading Platforms

Tickmill offers several trading platforms for its clients, including:

MetaTrader 4 (MT4): This is a popular trading platform among forex traders due to its advanced charting capabilities, numerous technical indicators, and ability to run automated trading strategies.

MetaTrader 5 (MT5): This is an upgraded version of MT4, offering additional features such as more timeframes, depth of market, and the ability to trade other instruments such as stocks and commodities.

Tickmill Trader: This is a proprietary platform developed by Tickmill, offering a user-friendly interface, advanced charting tools, and the ability to trade directly from charts.

Overall, Tickmill’s trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

Copy Trading

Tickmill offers copy trading features. This allows less experienced traders to copy the trades of more experienced traders, potentially increasing their chances of making profitable trades. It’s a strategy often used by new traders or those looking to diversify their trading. You can copy top traders on Tickmill’s website.

Deposits & Withdrawals

Another crucial factor while selecting a Forex broker is to see how to transfer money to or from your trading account. Tickmill accepts payments via Bank transfer, crypto payments, Visa, MasterCard, Skrill, Neteller, Sticpay, Fasapay, UnionPay, and WebMoney.

It does not charge any fees for deposits or withdrawals. However, clients are advised to check with their payment providers for any transaction fees that may apply at their end. Most deposits are instant, while the typical withdrawal processing time is within 1 working day.