Company Summary

| AvaTrade Summary | |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| Tradable Assets | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ |

| Islamic Account | ✅ |

| Min Deposit | $100 |

| Leverage | Up to 1:30 (retail)/1:400 (professional) |

| EUR/USD Spread | 0.9 pips |

| Trading Platform | AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, DupliTrade |

| Payment Method | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Inactivity Fee | $/€/£50 after 3 consecutive months of non-use |

| Customer Support | Live chat, contact form, WhatsApp: +447520644093, phone (vary by the region) |

Avatrade is an online forex and CFD broker that was established in 2006. The company is headquartered in Dublin, Ireland, and is regulated by several financial authorities around the world, including ASIC, FSA, FFAJ, ADGM, CBI, and FSCA.

As a market maker broker, Avatrade offers a range of tradable assets including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options. The broker provides clients with access to multiple trading platforms, including AvaTrade Mobile App, WebTrader, AvaSocial, AvaOptions, MT4, MT5, and DupliTrade.

Pros & Cons

When it comes to choosing a broker, it’s important to carefully consider the pros and cons to determine which one is right for you.

|

Pros |

Cons |

| Regulated by reputable financial authorities | Single account option |

| Competitive spreads | Inactivity fee and administration feecharged |

| Multiple trading platforms | |

| Rich and free educational resources | |

| Access to advanced trading tools and features | |

| Low to no slippage during high volatility | |

| Automated trading allowed |

Is Avatrade Legit?

Avatrade is regulated by multiple financial regulatory authorities, including the Australian Securities and Investments Commission (ASIC), the Financial Services Authority (FSA), the Financial Futures Association of Japan (FFAJ), the Abu Dhabi Global Market of the United Arab Emirates (ADGM), the Central Bank of Ireland (CBI), and the Financial Sector Conduct Authority of South Africa (FSCA). These regulatory bodies ensure that Avatrade operates with transparency, integrity, and in compliance with regulatory requirements.

• Ava Capital Markets Australia Pty Ltd – authorized by ASIC (Australia) registration no. 406684

• Ava Trade Japan K.K. – authorized by FSA (Japan) registration no. 2010401081157 and FFAJ registration no. 1574

• Ava Trade Middle East Limited – authorized by ADGM (UAE) registration no.190018

• AVA Trade EU Ltd – authorized by CBI (Ireland) registration no. C53877

• Ava Capital Markets Pty Ltd – authorized by FSCA (South Africa) registration no. 45984

Account Type

When it comes to account types, Avatrade only offers a standard account. This means that all clients will have access to the same features and trading conditions, regardless of the size of their deposit.

Avatrade has a minimum deposit requirement of $100, which is relatively low compared to other brokers in the industry. However, there are other brokers that have a lower minimum deposit requirement than Avatrade. For instance, HFM and XM have a minimum deposit requirement of $0 and $5, respectively.

Demo Account

Avatrade offers demo accounts for traders who want to practice their trading skills or test out the trading platform without risking real money. The demo account allows traders to access the full range of trading instruments and features on the Avatrade platform using virtual funds. It is a useful tool for new traders to get familiar with the platform and for experienced traders to test new strategies before using them in live trading. The demo account is available for 21 days and can be renewed upon request.

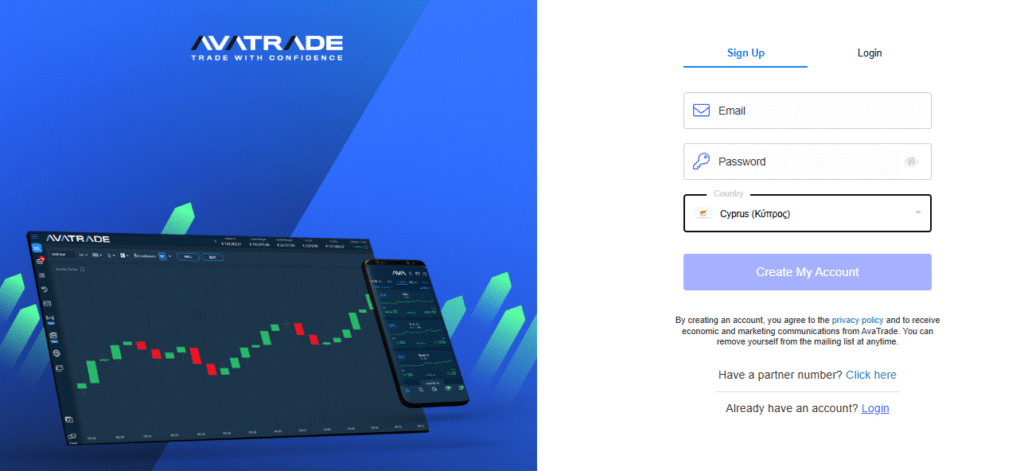

How to Open an Account?

When it comes to the process of opening an account with Avatrade, rest assured that it is one of the most streamlined and user-friendly experiences out there. Not only is the process simple and straightforward, but it is also designed to ensure that new traders can start their journey with ease.

First, you need to visit the Avatrade website and click on the “Register Now” button, which is prominently displayed on the homepage.

After filling out the registration form, you will need to verify your identity by submitting a copy of your government-issued ID and a recent utility bill or bank statement. This is a standard requirement for all regulated brokers and is done to ensure the security and integrity of the trading platform.

Once your account is verified, you can fund your account using one of the many payment options available, such as credit/debit card, bank transfer, or electronic wallets like Neteller or Skrill. After funding your account, you can download the Avatrade trading platform or use the web-based version to start trading.

Leverage

Avatrade offers leverage of up to 1:400 for forex trading and up to 1:200 for other instruments such as commodities and indices. This means that traders can control a larger position with a smaller amount of capital. However, it’s important to keep in mind that leverage can magnify both profits and losses, and traders should use it responsibly and with caution.

Avatrade also offers a range of leverage options for different account types, including 1:30 for retail clients in compliance with ESMA regulations and 1:400 for professional clients. It’s important to note that professional clients must meet certain criteria to qualify for higher leverage.

Spreads & Commissions (Trading Fees)

Avatrade offers competitive spreads and charges no commission fees for trading on its platform. The spreads offered by Avatrade vary depending on the trading instrument and market conditions. For example, the typical spread for EUR/USD is 0.9 pips, while for GBP/USD, it is 1.5 pips. Spreads for other instruments, such as indices and commodities, also vary.

However, it’s important to note that spreads can vary depending on market conditions and volatility. Additionally, Avatrade charges commissions on certain trading instruments such as CFDs, which can impact the overall cost of trading.

Trading Platform

Avatrade offers a selection of trading platforms that are designed to meet the needs of different types of traders. Here are some of the trading platforms offered by Avatrade:

AvaTrade Mobile App: This is a mobile app that is available on both iOS and Android platforms. It allows traders to access their accounts and trade on the go.

MT4: Avatrade offers the popular MetaTrader 4 (MT4) platform, which is widely used by traders around the world. MT4 is known for its user-friendly interface, advanced charting tools, and a range of custom indicators and expert advisors.

MT5: Avatrade also offers the MetaTrader 5 (MT5) platform, which is the successor to MT4. MT5 has several new features, including more advanced charting tools, a wider range of order types, and improved back-testing capabilities.

WebTrader: Avatrade’s WebTrader platform allows traders to access their accounts and trade directly from their web browser. The platform is easy to use and offers a range of trading tools and indicators.

AvaOptions: This is Avatrade’s platform for trading options. It offers a range of options trading tools, including risk management tools, and a range of customizable trading strategies.

Educational Resources

Avatrade offers a variety of educational resources to help traders improve their skills and knowledge. They have a comprehensive educational section on their website that includes a range of materials such as academy, trading for beginners, trading platforms turtorials, economic indicators, trading rules, blog, etc. The video tutorials are easy to follow and cover a variety of topics, including trading platforms, technical analysis, and risk management. Avatrade also offers webinars that are conducted by experienced traders and cover a variety of topics. These webinars are interactive, allowing participants to ask questions and receive feedback from the presenter.

Customer Support

Avatrade offers customer support through multiple channels, including live chat, contact form, WhatsApp: +447520644093, phone (vary by the region), and email. They also have a comprehensive FAQ section on their website, which covers a wide range of topics related to the platform and trading.