IC Markets, founded in 2007, is a globally recognized online trading broker, offering its services to over 1 million active traders. Based in Seychelles and regulated by the Financial Services Authority (FSA), IC Markets provides a secure and efficient trading environment. It ensures investor protection through segregated accounts, negative balance protection, and regulatory adherence.

The broker supports a variety of trading instruments, including CFDs on major and minor currencies, global stock indices, commodities, and shares, with spreads starting from 0.0 pips. With an array of trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, IC Markets caters to traders with different preferences across multiple devices.

Furthermore, its high leverage of up to 1:500, fast order execution, and VPS hosting options enhance the overall trading experience.

| 🔎 Broker | 🥇 IC Markets |

| 📌 Year Founded | 2007 |

| 👤 Amount of Active Traders | Over 1 million |

| 📍 Publicly Traded | None |

| 🛡️ Regulation | FSA (Seychelles) |

| 🌎 Country of Regulation | Seychelles |

| 🔃 Account Segregation | ✅Yes |

| 🚨 Negative Balance Protection | ✅Yes |

| 🧾 Investor Protection Schemes | ✅Yes |

| 🅰️ Institutional Accounts | ✅Yes |

| 🅱️ Managed Accounts | None |

| 💴 Minor Account Currencies | Major and Minor |

| 💶 Minimum Deposit | 200 USD |

| ⚡ Average Deposit/Withdrawal Processing Time | Typically 1-2 business days |

| 💵 Fund Withdrawal Fee | Generally no fee |

| 🔖 Spreads From | From 0.0 pips |

| 💷 Commissions | Variable |

| 🪙 Number of Base Currencies Supported | 10+ |

| 💳 Swap Fees | ✅Yes |

| 🏷️ Leverage | Up to 1:500 |

| 🖇️ Margin Requirements | Varies |

| ☪️ Islamic Account | ✅Yes |

| 🆓 Demo Account | ✅Yes |

| 🖥️ Order Execution Time | Milliseconds |

| 💻 VPS Hosting | ✅Yes |

| 📈 CFDs Total Offered | Extensive Range |

| 📉 CFD Stock Indices | Major global indices |

| 🍎 CFD Commodities | Oil, gold, etc. |

| 📊 CFD Shares | Major global stocks |

| 💴 Deposit Options | Bank transfer, credit/debit, e-wallets |

| 💶 Withdrawal Options | Bank transfer, credit/debit, e-wallets |

| 🖥️ Trading Platforms | MT4, (MT5, cTrader |

| 💻 OS Compatibility | Windows, macOS, iOS, Android |

| 🖱️ Forex Trading Tools | Advanced charting tools, etc. |

| 🥰 Live Chat Availability | ✅Yes |

| ☎️ Customer Support Contact Number | Varies by region |

| 💙 Social Media Platforms | Twitter,Facebook, LinkedIn, Instagram |

| 😎 Languages Supported | Multiple Languages |

| ✏️ Forex Course | ✅Yes |

| 📔 Webinars | ✅Yes |

| 📚 Educational Resources | ✅Yes |

| 🤝 Affiliate Program | ✅Yes |

| 🫶 Amount of Partners | Numerous global partners |

| 🫰🏻 IB Program | ✅Yes |

| ↪️ Do They Sponsor Any Notable Events or Teams | ✅Yes |

| ⭐ Rebate Program | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Safety and Security

IC Markets operates under the regulation of the Financial Services Authority (FSA) of Seychelles, which ensures that it adheres to strict compliance protocols and provides a secure trading environment for its clients. The FSA is responsible for overseeing financial services in Seychelles, ensuring fair and transparent markets. IC Markets’ adherence to these regulations means that clients’ funds are handled with the utmost security.

IC Markets complies with the Seychelles Securities Act, implementing internal risk management controls to ensure adequate capitalization and operational efficiency. External audits further confirm the broker’s commitment to full regulatory compliance. Additionally, client funds are segregated into accounts with top-tier banking institutions to provide an extra layer of security. IC Markets also adheres to Anti-Money Laundering (AML) regulations and has robust KYC (Know Your Customer) policies in place to prevent illicit activities.

With these measures in place, traders can engage in a secure and transparent trading environment with IC Markets.

Minimum Deposit and Account Types:-

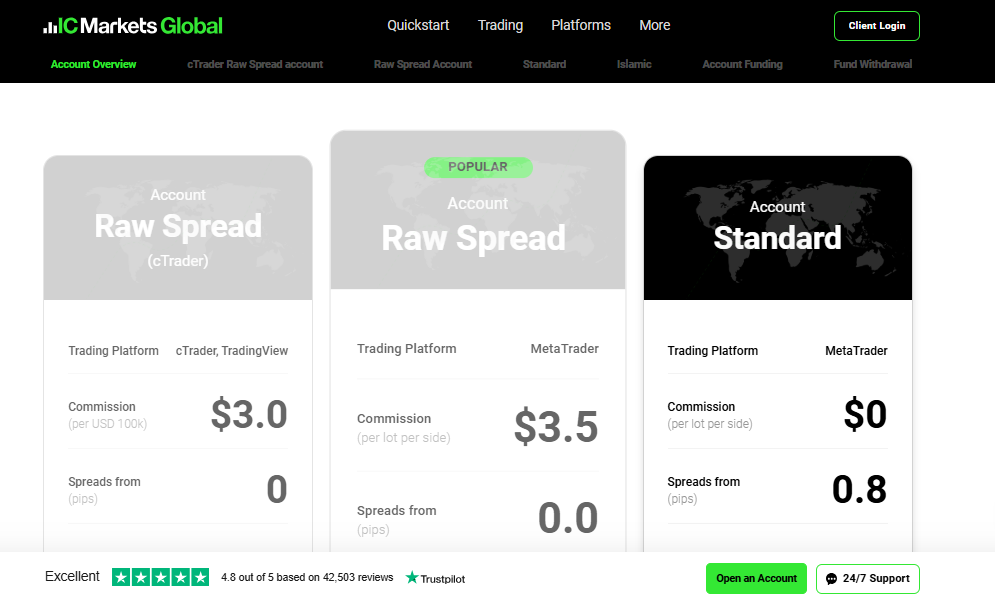

IC Markets offers a range of account types suited for traders with varying needs and experience levels. The minimum deposit for all account types is $200, making it accessible for both new and experienced traders to get started. The broker provides several account options, including the Raw Spread accounts (available on MetaTrader and cTrader platforms) and the Standard account, each offering different benefits based on your trading style.

Raw Spread Account: Known for some of the lowest spreads, the Raw Spread account provides spreads from 0.0 pips, with a small commission fee starting at $3 per 100k traded. This account is perfect for day traders, scalpers, and users of Expert Advisors (EAs).

Standard Account: The Standard account offers a commission-free experience with spreads starting at 0.8 pips. This is ideal for discretionary traders who prefer not to pay additional commissions.

Islamic Account: For traders who need a Sharia-compliant account, IC Markets offers an Islamic version of its Raw Spread account.

All accounts come with access to the popular MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader platforms, ensuring flexibility for traders to choose the platform that suits them best. Leverage of up to 1:1000 is available, and clients can trade micro-lots (0.01), which offers great flexibility in managing risk.

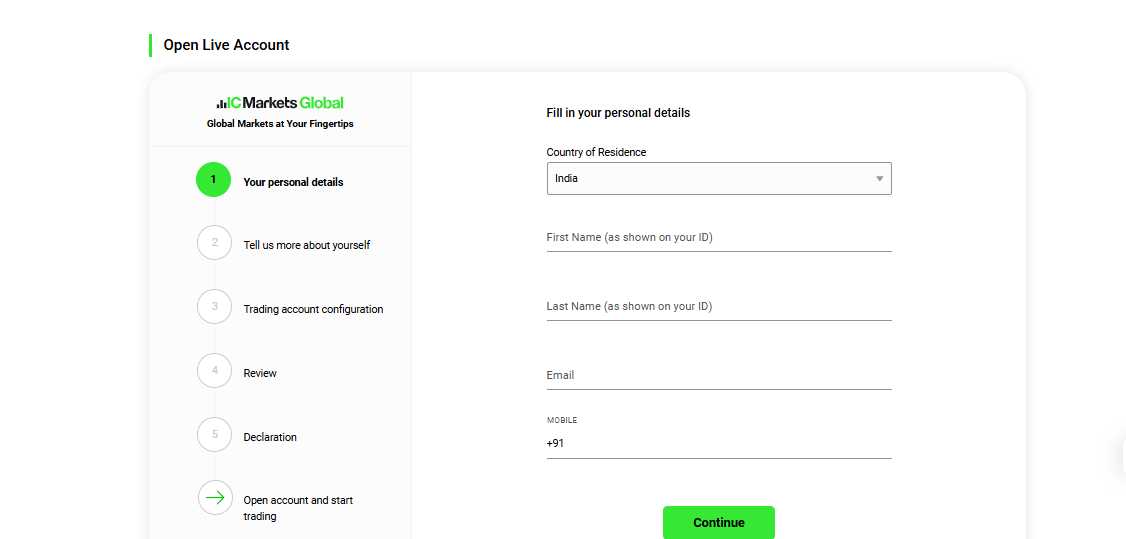

How To Open an IC Markets Account:-

To register an account with IC Markets, follow these easy steps:

Navigate to the IC Markets Website and choose the green “Open a Live Account” option.

Choose the account that best suits your requirements.

Complete the application form.

Fund your account

Download Your Trading Platform

Select your desired platform and download the program to your computer or mobile device.

Trading Platforms and Software:-

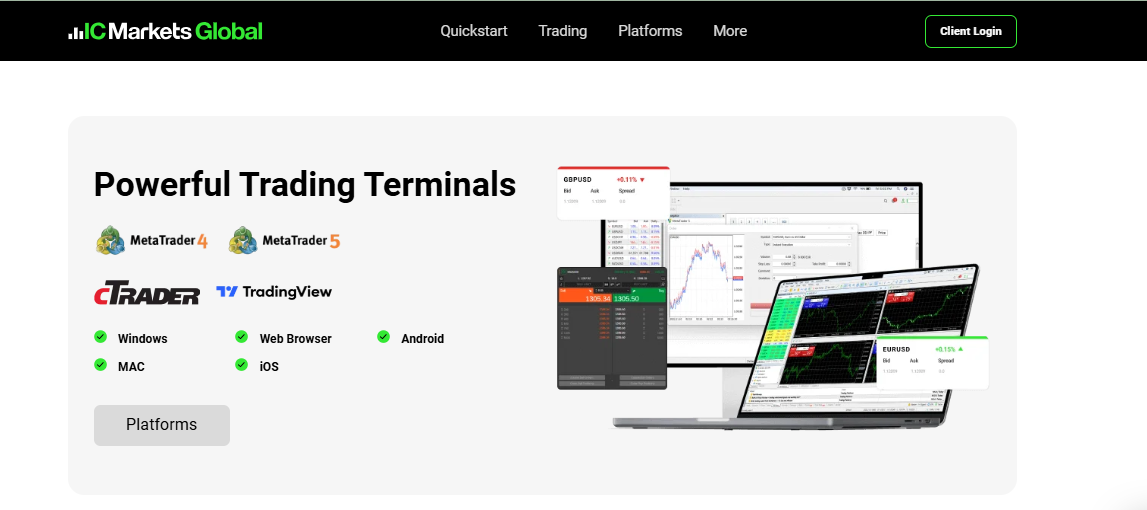

IC Markets offers three advanced and highly regarded trading platforms: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. Each platform is designed to cater to the needs of different traders, providing reliable and adaptable environments for trading across various financial markets.

MetaTrader 4 (MT4): Known for its dependability and flexibility, MT4 is ideal for traders who rely on advanced charting, technical analysis, and automated trading through Expert Advisors (EAs). The platform’s extensive library of indicators, custom scripts, and plugins offers traders the ability to personalize their trading experience based on specific strategies.

MetaTrader 5 (MT5): Building upon the success of MT4, MT5 introduces enhanced analytical tools, more timeframes, superior charting features, and multi-asset functionality. It facilitates seamless trading across Forex, stocks, and futures markets, while also offering advanced order management features and in-depth market views to help traders make informed decisions.

cTrader: A highly intuitive and user-friendly platform, cTrader excels in providing transparent trading conditions with Level II pricing and quick order execution. It supports advanced charting and algorithmic trading, making it a great choice for professional traders and those who require customized automated strategies. cTrader is also known for its efficiency and robust performance, especially when executing more complex trading strategies.

Markets Available for Trade:-

IC Markets offers the following Trading Instruments and Products:

64 currency pairings for trading

22 commodities

25 indices

11 distinct bond instruments

18 cryptocurrency alternatives

1,600 stocks

For individuals interested in derivatives, IC Markets provides four futures contracts that may be utilized to speculate or hedge on future price fluctuations of the underlying assets, such as commodities and indexes.

Are bonds available for trading?

Yes, IC Markets provides bond CFDs, which enable traders to bet on the performance of various government debt assets.

Fees, Spreads, and Commissions:-

IC Markets is renowned for offering some of the lowest fees, spreads, and commission structures in the trading industry. The broker’s Raw Spread accounts provide spreads starting from 0.0 pips, which are among the tightest in the market.

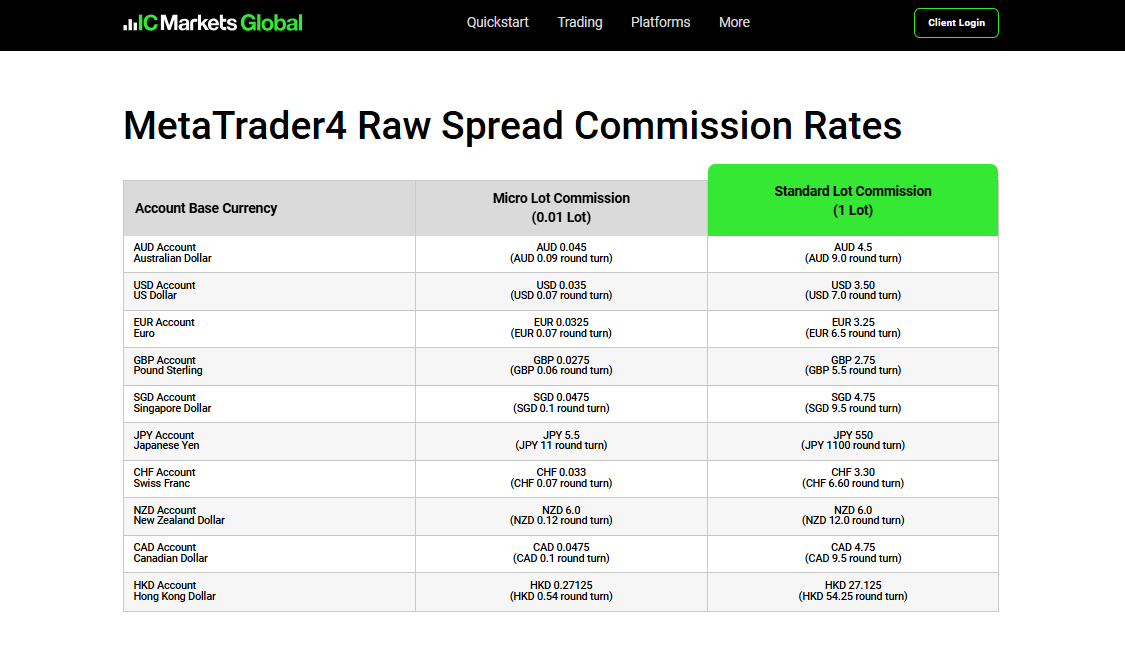

Traders are charged a commission starting at $3.50 per lot (per side) for the Raw Spread account on MetaTrader, while cTrader users pay $3 per 100k traded.

Raw Spread Account (MetaTrader): Offers spreads from 0.0 pips with a commission of $3.50 per lot (round turn). This account type is ideal for day traders and scalpers who rely on low spreads and minimal trading costs.

Raw Spread Account (cTrader): Offers spreads from 0.0 pips with a commission of $3 per 100k round turn, designed for traders who prefer cTrader as their platform.

Standard Account: This account charges no commission, with spreads starting at 0.8 pips. It is suited for traders who want to avoid additional fees while still benefiting from a competitive spread.

Leverage and Margin:-

Leverage and margin are key concepts in forex trading, impacting both risk and reward. IC Markets offers various leverage options and educational resources to help traders navigate these concepts.

Leverage allows you to control larger positions with a smaller deposit. For example, with 1:100 leverage, you can control $10,000 with only $100 in your account. While leverage boosts potential profits, it also increases risk.

Margin is the money required to open and maintain a leveraged position. It acts as a security deposit, and with higher leverage, the margin required is smaller. However, a lower margin means your account equity can be wiped out faster if the market moves against you.

Deposit and Withdrawal:-

IC Markets offers a variety of convenient deposit and withdrawal methods, ensuring that traders can easily fund and access their accounts. You can deposit using Bank Wire, Credit/Debit Cards, Cryptocurrency Wallets, or e-wallets like PayPal, Skrill, and Neteller. Withdrawals follow the same methods, with some additional security measures in place.

Importantly, IC Markets does not charge fees for deposits or withdrawals, though fees from financial institutions may apply.

Educational Resources

IC Markets offers a comprehensive education center to help traders of all levels master forex and CFD trading. From video tutorials to detailed guides on the basics of forex and CFDs, the platform provides valuable resources designed to enhance your trading skills.

Whether you’re just starting or looking to refine your strategies, IC Markets’ educational materials cover everything from market fundamentals to technical and fundamental analysis.

Very helpful to me talked me through the process in no time excellent service.

Avoid this company at all costs! I faced extraordinary challenges with withdrawal, thankfully

Fast and great costumer support!

Open to find a solution for everything 👍🏽